Remember when we were forced to wait weeks for our favorite shows to turn up on satellite TV? Those of you who are old enough to remember the days before streaming services will know what we’re talking about, but Gen Z probably doesn’t. Regardless of what era you were born in, we are all bombarded by the endless stream(ing) of video platforms that pop up at every corner.

Now, more than ever, consumers have a plethora of streaming options. But with so many different kinds of content for viewers to choose from, networks are constantly fighting for consumer attention and tailoring content to millions of different needs. Much of the recent conversation has focused on two media titans: Netflix and Disney.

The Beginning

Let’s travel back to ‘97 (a major throwback) when Netflix launched as a mail-order DVD rental company. Renters would browse and order films through their website, and Netflix would post DVDs to customers' doors1. After renters had finished viewing the films, they would post them back to Netflix. At the time, each rental was $4 + $2 for shipping2, but things changed in 1999 when the company switched to a subscriber-based model, giving users the chance to keep DVDs for as long as they liked1.

Thanks to its new service, Netflix’s growth soared. But in 2000, when the company had 300,000 subscribers and was losing money3, it was offered to be acquired by brick-and-mortar rival Blockbuster for $50 million4. Fortunately, Netflix co-founder Reed Hastings turned down the offer. Blockbuster declared bankruptcy in 20105, guess they dodged a bullet.

Netflix was fortunate to have its fate reversed so quickly. The sale of DVD players took off in early 2001, making them more affordable and allowing Netflix to gain new subscribers. In 2002, the company announced it would be going public, offering 5.5 million shares of its common stock at a price of $15 per share6.

In 2003, the company recorded its first quarterly net profit of $3.3 million with a 37% increase in subscribers, reaching more than 1.1 million subscribers7. By 2007, Netflix had become a household name, transforming from a low-cost DVD mail service to a ground-breaking subscription-based streaming service. Though there were other streaming services in place, Netflix had a first-mover advantage as it operated on a subscription model and had acquired much of its content from different studios. The company’s early success allowed it to grow rapidly and establish itself as an industry leader. From 2007 to 2022, Netflix’s subscriber base grew from 7 million to 221 million, a 3000% increase8.

Enter Disney

Put your hands up if you think Disney entered the streaming industry in 2019 with the launch of Disney+9. We know quite a few of you have those hands up, but you’re not the only ones.

Many are under the impression that Disney recently got involved in the streaming space when it announced plans to remove its content from Netflix by 2019 and launch its own streaming service for its own titles. But in fact, the company has been making moves since 2009, when it joined Hulu as a minor stakeholder10.

To top it off, their announcement in 2017 to cut ties with Netflix wasn't a random decision. They had actually been laying down the groundwork since 2016 when they bought a 33% stake in BAMTECH Media, a video streaming technology company. In 2018 Disney became the majority stakeholder in BAMTECH and rebranded to Disney Streaming Services12. The following year, Disney+ was live and shaking the market. Disney rallied 9%, reaching all-time highs, and Netflix tumbled over 3% as investors worried about its new market entry's potential to hurt subscription growth13.

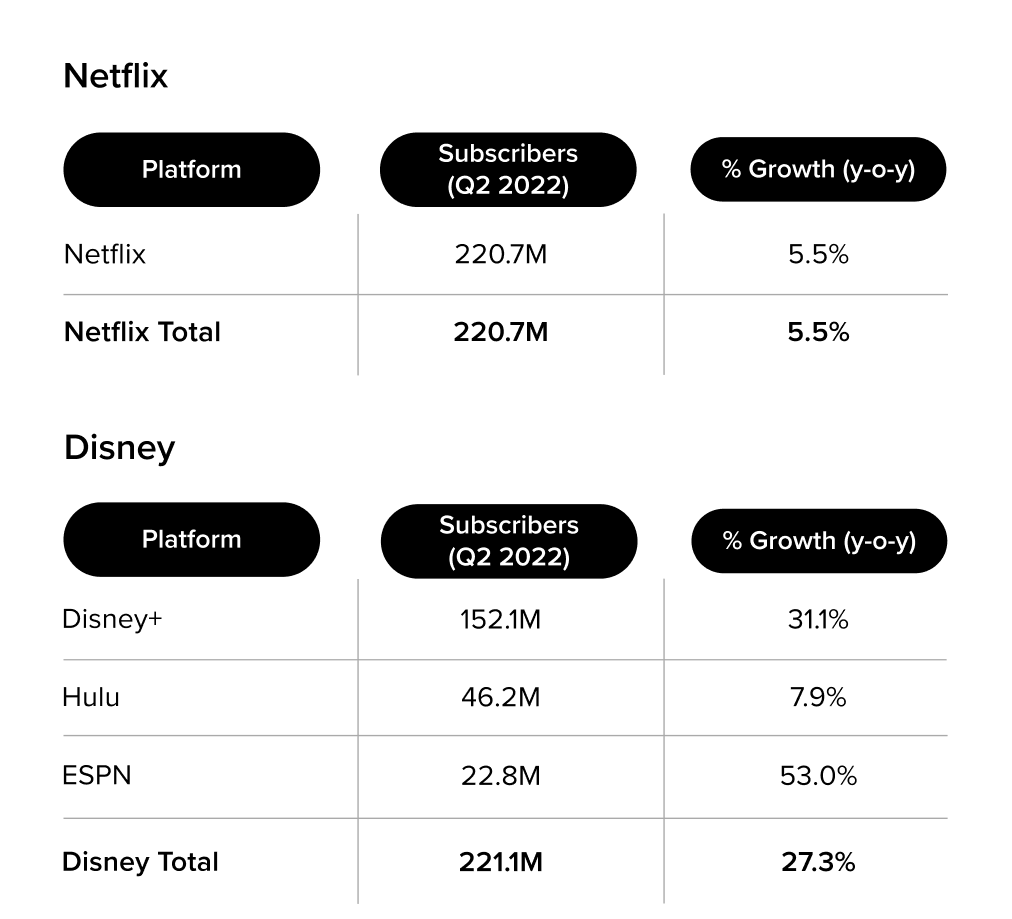

While Netflix enjoyed a head start in the streaming market, Disney’s platforms are quickly gaining momentum. When it launched, Disney+ was forecasted to have at least 60 million subscribers in its first five years, ending in 202414. But within 16 months of going live, the service hit 100 million subscribers — a feat that took Netflix 10 years to accomplish. Combined with its other US streaming services, Hulu and ESPN+, the company has now edged ahead of rival Netflix, with more than 200 million subscribers14.

The Ultimate Winner

In the streaming world, content is king. Being able to produce top quality content tailored to millions of subscribers' interests is the winning factor. And for Disney, this has been easier compared to Netflix. Disney has a track record of being one of the most successful Hollywood film and TV studios in history. It is home to many of the world’s biggest franchises and characters thanks to its multibillion dollar shopping spree. The company is taking aggressive action to reach profitability by 2024 while overtaking Netflix as part of its growth mode. So far, it has added 14.4 million subscribers in Q2 202215, whereas Netflix lost 1 million subscribers16 in a decade.

As competition for subscribers has intensified, the cost of staying on top has skyrocketed. Both companies are battling for customers at a time when inflation is rising and many are cutting back on entertainment services due to economic hardship. Netflix plans to splurge $17B to produce and license films and TV shows this year, with an added $23B for long-term content costs, plus $14.8B in long-term debt17. They will also launch a cheap ad-supported tier starting in November to make up for the lost subscribers. On the other hand, Disney is spending $30B on content across all its TV, film, and streaming services this year, including live sports rights such as the NFL for ESPN18.

Regardless of Disney’s position in this changing media market, the competition between both rivals is never-ending as content continues to grow and change, and it just depends on who is able to grab the majority of market share.

Overall, despite the current situation, investors should not only be focused on recent losses and should conduct their own research to weigh the pros and cons of before investment.

1 https://about.netflix.com/en

2 https://interestingengineering.com/culture/the-fascinating-history-of-netflix

3 https://money.cnn.com/2018/07/24/technology/netflix-2000s/index.html

4 https://www.cnbc.com/2020/09/22/how-netflix-almost-lost-the-movie-rental-wars-to-blockbuster.html

5 https://money.cnn.com/2010/09/23/news/companies/blockbuster_bankruptcy/index.htm

6 https://ir.netflix.net/investor-news-and-events/financial-releases/press-release-details/2002/Netflix-Announces-Initial-Public-Offering/default.aspx

7 https://s22.q4cdn.com/959853165/files/doc_news/archive/e065b436-b61a-46c8-b1ad-8bb7fa357f12.pdf

8 https://www.demandsage.com/netflix-subscribers/

9 https://www.cnbc.com/2018/11/08/disneys-new-netflix-rival-will-be-called-disney-plus-and-launch-late-2019.html

10 https://www.wired.com/2009/04/disney-scores-sweetheart-hulu-deal/

11 https://www.forbes.com/sites/maurybrown/2016/08/09/disney-co-makes-1-billion-investment-becomes-minority-stakeholder-in-mlbams-bamtech/?sh=2fd9d12a1d76

12 https://thewaltdisneycompany.com/walt-disney-company-acquire-majority-ownership-bamtech/

13 https://www.nasdaq.com/articles/how-disney-is-already-reforming-the-streaming-space-2019-11-14

14 https://www.cnbc.com/2020/12/11/after-showing-massive-growth-disney-hikes-5-year-subscriber-goal-.html

15 https://techcrunch.com/2022/08/10/disney-soars-to-152-1-million-subscribers-after-adding-14-4-million-in-q3/?guccounter=1&guce_referrer=aHR0cHM6Ly9zZWFyY2guYnJhdmUuY29tLw&guce_referrer_sig=AQAAAAB3yFVUG0yCsx5YU4Cm0tlVZO-c5TUeXXdAtOPjQ5Fi6p8J-ayCminFurMEyf3LDwsnZBG1INfNv1hogjjX1dD8RsSr6UyEG0stNFQDLumPAZoA5LIkgwwpf1DBpZV3-lOEdrK6ClXh61LS-NomBqHrvw0raBTqmIRaBvu8AJbn

16 https://www.bbc.com/news/business-62226912

17 https://thestreamable.com/news/netflix-to-peak-content-spending-at-17-billion-through-2023

18 https://nypost.com/2021/11/26/disney-to-spend-33b-next-year-on-new-shows-and-movies/

baraka is regulated by the DFSA

Past performance is no guarantee of future results. Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.