The World Cup is right around the corner, and in just a few days, half of the world along with all their national teams will be playing on one pitch for one goal: taking that FIFA golden trophy home.

While the hype for the World Cup builds up, we felt it was a good time to provide you with some insight into the football investing world. Both activities require a strong playbook. In the investment world, it is common to diversify your team of professionals so there is safety for your holdings without having to worry about whether your investment is a coin toss.

Join us as we deep dive into how the strategies used in a game of football can translate into investing and how a renowned football team took to the public markets.

Investing is A Lot Like Football

As the football industry grows and more teams are created, more capital enters the market, and players must adapt to remain successful in their sport—just as investors need to adapt to ever-changing markets to remain successful.

Here are some principles that can help you build a winning team and a strong investment portfolio:

- Define your goals. The first step in creating a financial plan is to understand what kind of risk-taker you are. All investments have some degree of risk, which means you should think about the different risks and returns of every saving and investment product you’re considering.

- Past performance is no guarantee of future results. When you're trying to assemble a winning team, scouting and studying players can go a long way toward picking the right players and maximizing your talent. The same applies to investing, a player’s or company's success in the past does not guarantee future returns. Players can get hurt, companies may have to recall products, or the performance might be a short-term fluke.

- Don’t put all your eggs in one basket. A great football team has different players playing in different positions. Each team has 11 players with 4 main positions: Goalkeeper, Defender, Midfielder, and Forward. You want to pick players from a variety of positions, who generally score consistently throughout the season, without big ups and downs from one week to the next. A well-diversified portfolio has different investments in different industries and sectors. This way, your eggs are not all in one basket. You maximize your returns and minimize your risks.

- Think long-term. We know watching a football game unleashes a roller coaster of emotions, and the same goes for investing. When building your team you take into account players' match-ups, review their projections and do your research based on their perceived value and not because they're the latest hype, which also applies to investing. Just because Ronaldo has a bad week doesn't mean you should dump him. It's all about the long haul, not one isolated victory. The same is true of investing; look at the big picture!

Cashing in on Clubs

Many football fans dream of owning a piece of their favorite club—share ownership brings fans closer to their team, and if the team does well, it can even generate a little income. It can also be a way of protecting the integrity of community institutions from the whims of club owners who just throw around money on players and big names for trophies quickly rather than creating a structured plan and vision for long-term success.

While it is rare for sports franchises to be publicly traded, the idea is not entirely foreign – in fact, there are 15 clubs listed between local and international exchanges1.

Manchester United is the most notable football club to go public, and with good reason: the English team is the largest publicly-traded football club in the world, making its mark on the public market for almost 30 years2.

Check out their journey3:

- 1991: Man United floats on the London Stock Exchange (LSE)

It aims to raise £10 million, but falls short and finally raises £6.7 million. - 2003-2005: Malcolm Glazer acquires ownership of Man United

This raises the club’s market capitalization to £790 million, and it delists from the LSE. - 2012: Man United lists on the New York Stock Exchange (NYSE). It aims to raise £62.8 million in this IPO but surpasses this with a final raised value of £146.3 million. Interestingly, George Soros was the biggest investor in this deal, buying a nearly 2% stake in the club.

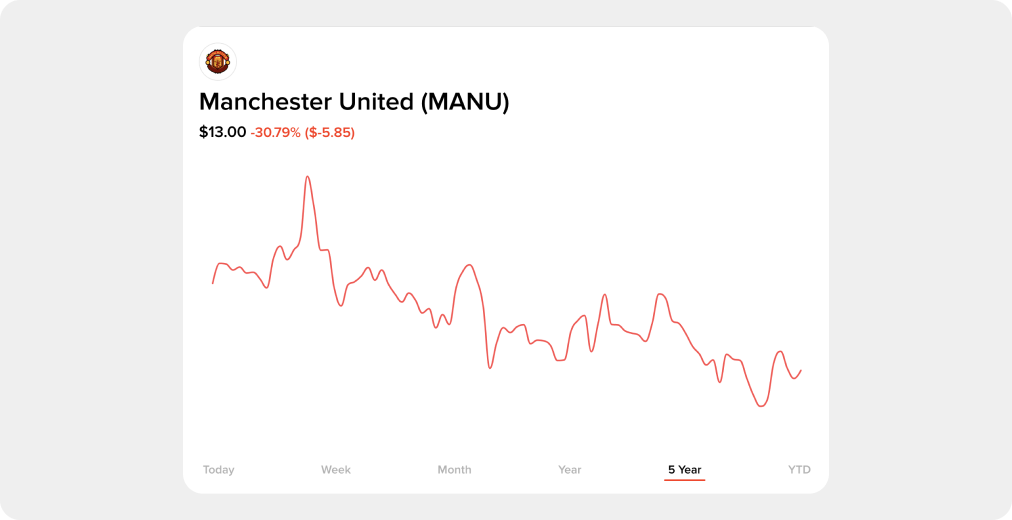

However, since its mark on the US stock market, the company hasn’t been performing well due to its pitch performance. Like any company listed on the stock market, the performance of its shares depends on its overall performance. For Manchester United, their stock performance is ultimately hinged on how well they play on the pitch and since their long-time manager Sir Alex Ferguson retired in 2013, it has taken a hit.

Winning cup competitions means more games to broadcast and more match-day revenue, but after failing to qualify for the Champions League last season, the club is playing in the less prestigious Europa League4.

A Losing Game

For its fiscal year 2022, the overall revenue was up 18% on the previous year at £583.2M This reflected a return to full stadiums after two pandemic-hit seasons4.

The club’s debt has increased by 22.7%, from £419.5M to an eye-watering £514.9M. This is partly due to a “revolving credit facility” (a loan) the club used during the pandemic to offset almost £200M in losses. The annual operating loss was £87.4M4.

Although Manchester United shares might seem like a nice piece of merchandise for many lifelong fans, shares in the Red Devils have historically offered poor returns. This may not be surprising, considering that historically publicly traded professional sports teams rarely outperform the market, and some don’t even offer dividends or grant shareholders control over company decisions.

Given the upcoming World Cup, what do you think will be the effect on this stock as many of its players will be once again on the field, representing their national teams?

1 https://www.marketwatch.com/story/the-boston-red-sox-will-no-longer-be-taken-public-here-are-the-sports-franchises-you-can-invest-in-11613070621

2 https://www.forbes.com/sites/chrissmith/2012/08/10/manchester-united-ipo-history-says-dont-buy/?sh=70c295c248fb

3 https://www.visualcapitalist.com/football-fever-investing-in-the-beautiful-game/

4 https://www.fool.co.uk/2022/10/31/if-id-invested-2k-in-manchester-united-shares-5-years-ago-heres-what-id-have-now/

Past performance is no guarantee of future results. Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.