The days of CDs, cassettes, and walkmans are long past us. Despite the surge in demand for vinyl and record players among Millennials and Gen Z, music streaming services remain king. In recent years, music streaming platforms have radically transformed how people access and engage with recorded music. Modern streaming platforms are revolutionizing the experience of consuming music by providing editorially curated and personalized playlists and recommendations.

When it’s time to choose the best music streaming service, Apple Music and Spotify immediately come to mind. These two music streaming giants have long been in competition with each other when it comes to paid subscribers, services, and subscription prices. Each service sports feature sets that cater to specific user needs. It can be difficult to choose between the two—so let’s dig a little deeper into what sets them apart.1

A Brief of the Beef

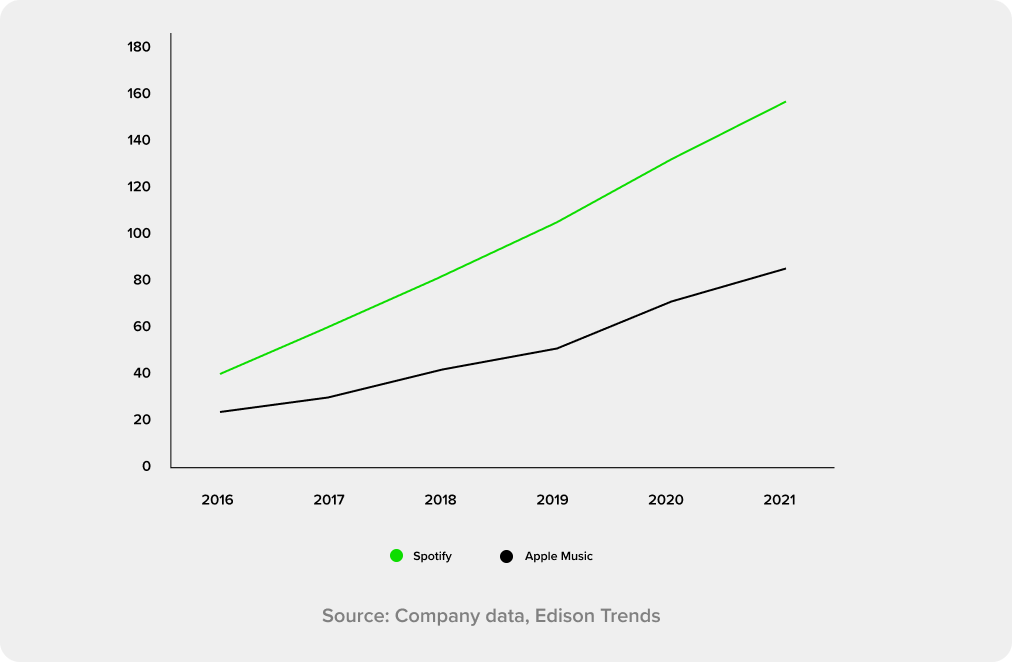

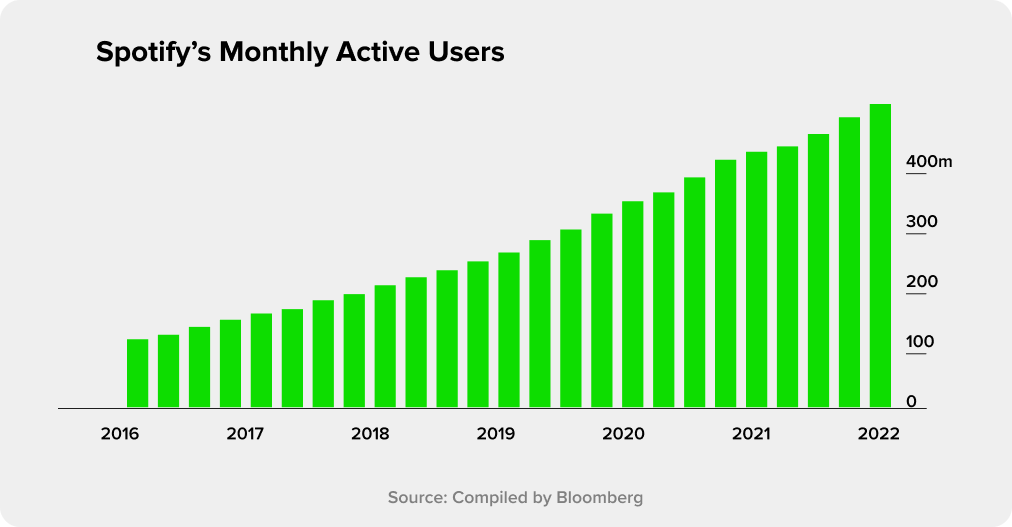

In 2008, Spotify was introduced in Sweden with the express purpose of democratizing music. Since its launch, it has steadily expanded to offer more than 80 million tracks, 195 million paid users, 456 million monthly active users globally, and availability in more than 184 countries.2

In contrast, Apple Music was made available as an iOS app in June 2015. Apple Music gained over 10 million paying subscribers worldwide in just 6 months after its release, a feat that took Spotify roughly 7 years to complete. Apple Music has been ranked as the second-most popular music streaming service in the world, with a catalog of more than 60 million tracks and around 88 million paying subscribers (as of last year).3

In the most recent development of the Apple Music vs. Spotify beef, Apple has been repeatedly rejecting Spotify’s news audiobook app from being launched on their App Store. These rejections are only a small clash in a long history of feuds between these media giants. During the past decade, the two companies have been battling over Apple’s decision to collect a 30% fee on the services that apps listed on the App Store sell.

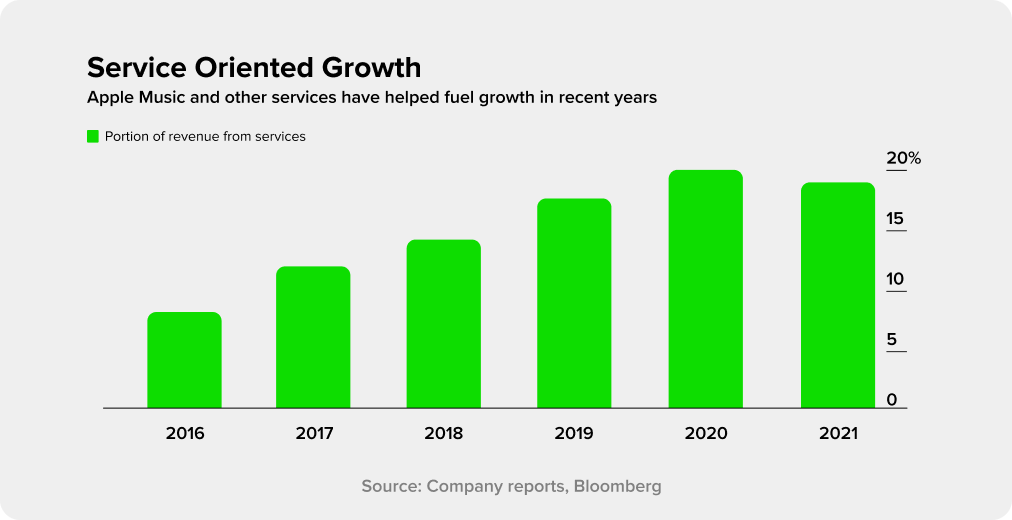

The App Store is at the center of Apple's strategy to transition from a business based on the sale of devices to one based on the sale of software and services. The business produces profits of almost 80%, with an estimated $24 billion in annual sales from the 30% fees it receives.4

Price Hikes

Due to rising licensing costs, Apple recently raised the prices for its music and TV+ services for the first time. This move could give rivals an advantage in the fiercely competitive streaming market. Since its debut in 2015 at $9.99, the publisher has expanded its music platform offering, remaining one of the cheapest streaming services up until now. As of right now, prices have been increased to $10.99 for an individual subscription. This is the first time, since its launch, that the tech giant has raised its subscription prices in the U.S., and international markets will soon experience similar price hikes. As a result, Apple Music is effectively deemed to be more expensive than other streaming services like Spotify.5

Consumers continue to struggle with increased subscription fees around the globe amid inflation and rising operating expenses.6 Apple claimed that the switch to Apple Music was necessary due to an increase in licensing fees, which would result in higher streaming fees for musicians. However, price increases have typically been beneficial for media equities in this period of rising input prices since more robust, customer-focused companies have shown they can keep subscribers while generating more money from services. A prime example of this is how Spotify's stock increased in value in the spring of 2021 after it announced price increases across the board, including a monthly fee of an extra dollar for family plans in the United States.7

Earnings

Apple's consistent push into streaming is a part of a larger initiative to increase service revenue. From less than 10% in 2015, that segment now accounts for roughly 25% of the company's sales, or nearly $20 billion in the June quarter.8

Due to slower-than-expected growth in advertising sales, Spotify recently disclosed a loss for the third quarter of about $193.3 million. According to the company, the addition of seven million new paid subscribers contributed to a 21% increase in overall revenue to about $3 billion.9

In Q3 of 2022, Spotify reported 195 million paid subscribers and 456 million active monthly users. Recent price increases for Apple Music suggest that Spotify may have more clout going forward. As a result of the news, Spotify experienced its biggest intraday rally in nearly three months, rising as much as 9.4% to $97.07.10

More than ever before, Spotify is still investing in advertising, and its ad-supported revenue increased by 19% from the previous year and accounted for 13% of its overall revenue. Podcasting, according to the company, has fueled growth. Since Spotify started offering podcasts in 2015, it has amassed more than 4.7 million of them.11

Who’s in the Lead?

There is no denying that the over decade-long competition between Spotify and Apple Music has helped the music streaming industry reach record heights and state-of-the-art feature sets. While iTunes and iPods played a big role in revolutionizing the music industry in the early 2000s, Apple seemingly failed to predict that music streaming would be the next step in the evolution of digital music.

The two music streaming platforms actively shape what music people engage with and how they engage with it. Apple Music has made some serious strides since its launch in 2015; catching up with Spotify in only a few years. However, despite their commendable efforts, Spotify still reigns supreme.

1 https://journals.sagepub.com/doi/10.1177/2053951719888770

2 https://newsroom.spotify.com/company-info/

3 https://www.businessofapps.com/data/apple-music-statistics/

4 https://www.nytimes.com/2022/10/25/business/spotify-apple-audiobooks-app.html

5 https://www.ft.com/content/8843a0ef-8c36-44ed-a3ba-4280b62ee840/

6 https://www.thenationalnews.com/business/technology/2022/10/25/apple-raises-prices-for-music-and-tv-services-for-first-time/

7 https://seekingalpha.com/news/3894439-why-did-spotify-stock-jump-today-apple-flexes-pricing-power

8 https://www.bloomberg.com/news/articles/2022-10-24/apple-hikes-price-of-apple-tv-to-6-99-raises-music-to-10-99

9 https://www.nytimes.com/2022/10/25/business/spotify-apple-audiobooks-app.html

10 https://www.hollywoodreporter.com/business/business-news/spotify-q3-2022-earnings-1235248536/

11 https://www.cnbc.com/2022/10/25/spotify-spot-earnings-q3-2022.html/

baraka is regulated by the DFSA

Past performance is no guarantee of future results. Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.